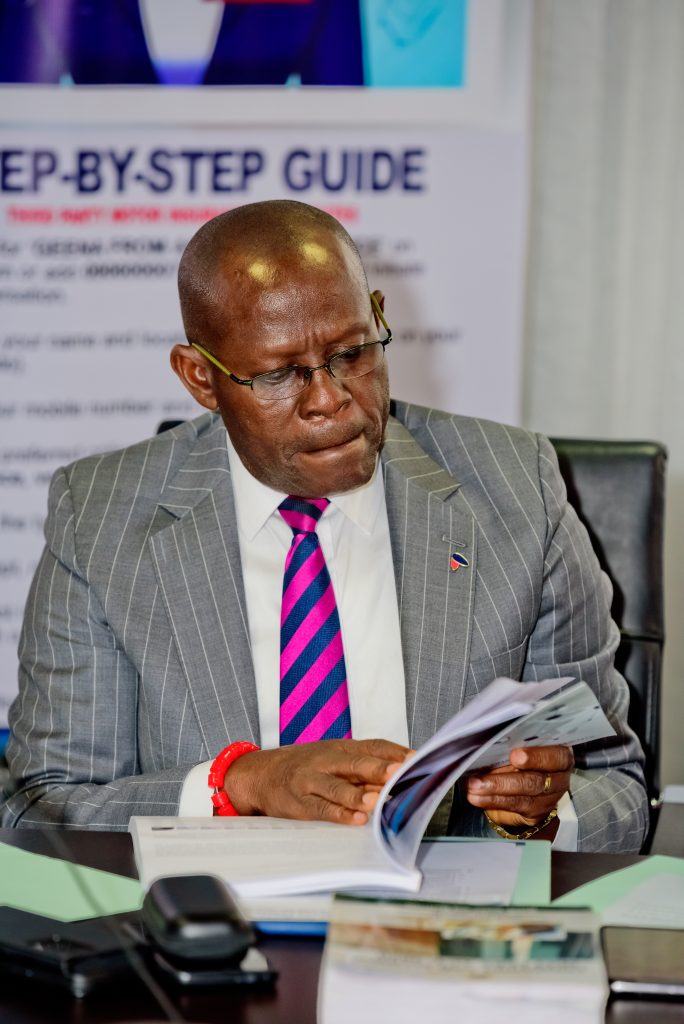

Dr Linus Nkan, Chairman, Anchor Insurance Company Limited at the 35th AGM held on July 17, 2025

LAGOS, NIGERIA – July 17, 2025 – Distinguished Shareholders, esteemed Members of the Board, my dear Management Team, representatives of the National Insurance Commission (NAICOM) and other regulatory bodies, members of the Press, ladies and gentlemen, it is with great pleasure and a deep sense of responsibility that I welcome you all to the 35th Annual General Meeting of our Company, Anchor Insurance Company Limited. On behalf of the Board of Directors, I thank you for making the time to join us as we review the Company’s performance for the financial year ended December 31, 2024.

The past year was both challenging and transformational for our industry and for Nigeria as a whole. Against the backdrop of a complex economic environment, marked by rising inflation, currency volatility and shifting regulatory dynamics, your Company demonstrated remarkable resilience and strategic astuteness. We remained committed to our mandate—delivering value to our policyholders, partners and you, our shareholders.

Despite macroeconomic headwinds and intensifying competition within the insurance space, we recorded notable improvements in our top-line performance, expanded our digital capabilities, strengthened our risk management frameworks and deepened customer engagement. These gains reflect the collective effort of our Management and Staff as well as the continued trust and support of our shareholders.

For a good understanding of the environment under which we performed during the period we are reviewing, the following brief reviews will be necessary:

Global Economy:

The world economy in 2024 was characterized by a complex interplay of factors. Whereas some economies showed resilience, others faced significant headwinds. Advanced economies, for instance, grappled with inflation and monetary policy adjustments while emerging markets generally outperformed expectations.

Geopolitical tensions, however, dampened overall growth and created uncertainty for investors. Tensions between China and Western nations, the ongoing war in Ukraine and instability in parts of Africa and the Middle East contributed to a more fragmented global trade system.

While global supply chains continued to normalize post-COVID, strategic decoupling or disconnection – especially in technology and critical minerals – intensified. Multinational firms increasingly moved their supply chains and manufacturing operations to nations that were considered political, economic or security allies — instead of relying on potentially hostile or unstable countries.

Nigerian economy

The nation’s economy exhibited a mix of resilience and vulnerability, shaped by global headwinds, domestic policy shifts and persistent structural challenges. The economy recorded a modest growth rate of approximately 3.2%. However, this growth remained uneven and real Gross Domestic Product (GDP) per capita continued to lag behind population expansion, limiting improvements in living standards.

Inflation remained a pressing concern throughout the year. Headline inflation hovered around 30% for much of 2024, driven primarily by soaring food prices, foreign exchange volatility, subsidy removals and supply chain constraints. Despite efforts by the Central Bank of Nigeria (CBN) to tighten monetary policy—including multiple interest rate hikes and liquidity management strategies—exchange rate instability persisted, partly due to dwindling external reserves and speculative activities in the forex market.

Meanwhile, insecurity in several parts of the country, particularly in the North-West and Middle Belt regions, continued to hamper agricultural productivity and displaced communities.

Nigerian Insurance

The Nigerian insurance industry in 2024 achieved exceptional growth in premiums, revenue, profitability and market capitalization with gross premium income reaching N1.562 trillion, a 56% increase from N1.003 trillion in 2023, Profit Before Tax rising to N142.2bn (75.5%), industry total assets growing to N3.9 trillion by 46%. It further paid a total claim of N622 billion (40% of the Gross Written Premium).

This upward trajectory was driven by various factors, including increased public awareness, enforcement of compulsory policies as well as timely claims settlements, a general upward repricing of premiums, non-life sector strength, ongoing regulatory reforms and digital innovation. However, it contended with regulatory complexities, inadequate infrastructure, fraud, limited product diversity, low insurance penetration and macroeconomic headwinds like inflation, interest rate tightening, currency volatility and rising claims.

Despite the above upward performance, the contribution of insurance (about 0.5% to 0.7%) to Nigeria’s total Gross Domestic Product (GDP) remains relatively small.

Our performance:

My valued Shareholders, 2024 was a defining year for the Company — one that tested our resilience, affirmed our strategic direction and highlighted the strength of our people, systems and partnerships. Despite macroeconomic uncertainties, regulatory shifts and evolving customer expectations, our decision to stay focused, pro-active and committed to delivering long-term value paid off hugely for the Company.

At the end of 31st December 2024, we wrote a Gross Premium of N34.2bn from N18.2bn in 2023, representing a growth of 87.9% and an Insurance Revenue of N33.9bn, indicating a 97.2% achievement over the N17.1bn result of 2023. Our Shareholders’ Funds rose by 27.1% from N14.4bn recorded in 2023 to N18.3bn in 2024, while the Company’s Total Assets grew to N23.6bn from N19bn in the corresponding year of comparison. We paid out N5.3bn as claims to our affected genuine policyholders as against the N2.9bn figure in 2023, affirming our capacity to handle all valid claims, regardless of volume.

Our Profit After Tax grew by an impressive 236.4% from N1.01bn in 2023 to N3.7bn in 2024 financial year.

Dividend:

Dear Shareholders, you can recall the Board assured at the last Annual General Meeting that it would not fail to improve on the dividend rate whenever the Company recorded a quantum profit leap.

In line with the above, the Board is proposing a dividend of 4.5k per share for your approval at this Meeting to be paid to the Shareholders subject to deduction of withholding tax using the appropriate rate.

Future Outlook

As we look to the future, we are optimistic. Our strategic priorities remain clear — enhancing operational excellence, driving innovation and fostering inclusive growth within the Nigerian insurance landscape. We are fully committed to positioning your Company, Anchor Insurance Company Limited, not just as a leader but as a catalyst for financial security in Nigeria.

Conclusion:

I am proud of the progress we have made in strengthening our financial position, deepening customer trust and leveraging technology to expand access to our products and services across Nigeria. These achievements would not have been possible without the collective effort of our Board, Management Team, Staff, Shareholders and policyholders. Thank you all for your continued support and confidence.

Dear Shareholders, Distinguished Directors and my dedicated Management Team, this meeting presents an opportunity not only to review our 2024 Audited Financial Statements but also to highlight the strategic direction for the future. We believe the path ahead offers even greater prospects for growth, innovation and sustained profitability.

As we proceed with today’s agenda, therefore, I encourage open and constructive engagement. Your insights and questions remain vital to our continued progress.

Thank you for your attention, your belief in our journey and for being part of our 2024 story. Together, we will continue to build a stronger, more impactful Anchor Insurance.

Once again, I warmly welcome you and thank you for your unwavering support.

God bless you all.

Long live Anchor Insurance Company Limited.

Dr. Nsikan Linus Nkan, FCA

Chairman

L-R: Mr. Ikuomola Adebisi (Executive Director, Technical), Mr. Akin Taiwo (Board Member), Dr. Ebose Augustine Osegha (MD/CEO), Dr. Nsikan Linus Nkan (Chairman), Mr. Ime Umoh (Company Secretary/Legal Adviser) and Prof. Paul Udofot (Board Member) at the 35th Annual General Meeting of Anchor Insurance Company Limited in Lagos.